Responding to the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

The Task Force on Climate-Related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in 2015 and submitted its final report containing recommendations for disclosures of climate-related information that has a financial impact in June 2017. The TCFD recommends disclosure of four categories of information: governance, strategy, risk management, and metrics and targets . With regard to disclosures of strategy in particular, it recommends that companies consider various climate scenarios.

The Yamato Group recognizes that to achieve the sustainability of its business, it needs to identify risks and opportunities for society and companies that arise from climate change, evaluate their effects, and develop countermeasures. We conducted scenario analysis for Yamato Transport Co., Ltd. in fiscal 2021, based on the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). The Group announced its endorsement of the TCFD recommendations in September 2022. The Group continues to revise its evaluations, including an additional financial impact evaluation of physical risks undertaken in fiscal 2023. The Group will strive to enhance the sustainability of its business by making clear the impact of climate-related issues on its business and develop countermeasures, particularly against issues having significant effects, while promoting communication with its stakeholders to enhance corporate value.

Governance

TCFD recommended disclosures

a. Describe the board's oversight of climate-related risks and opportunities.

b. Describe management's role in assessing and managing climate-related risks and opportunities.

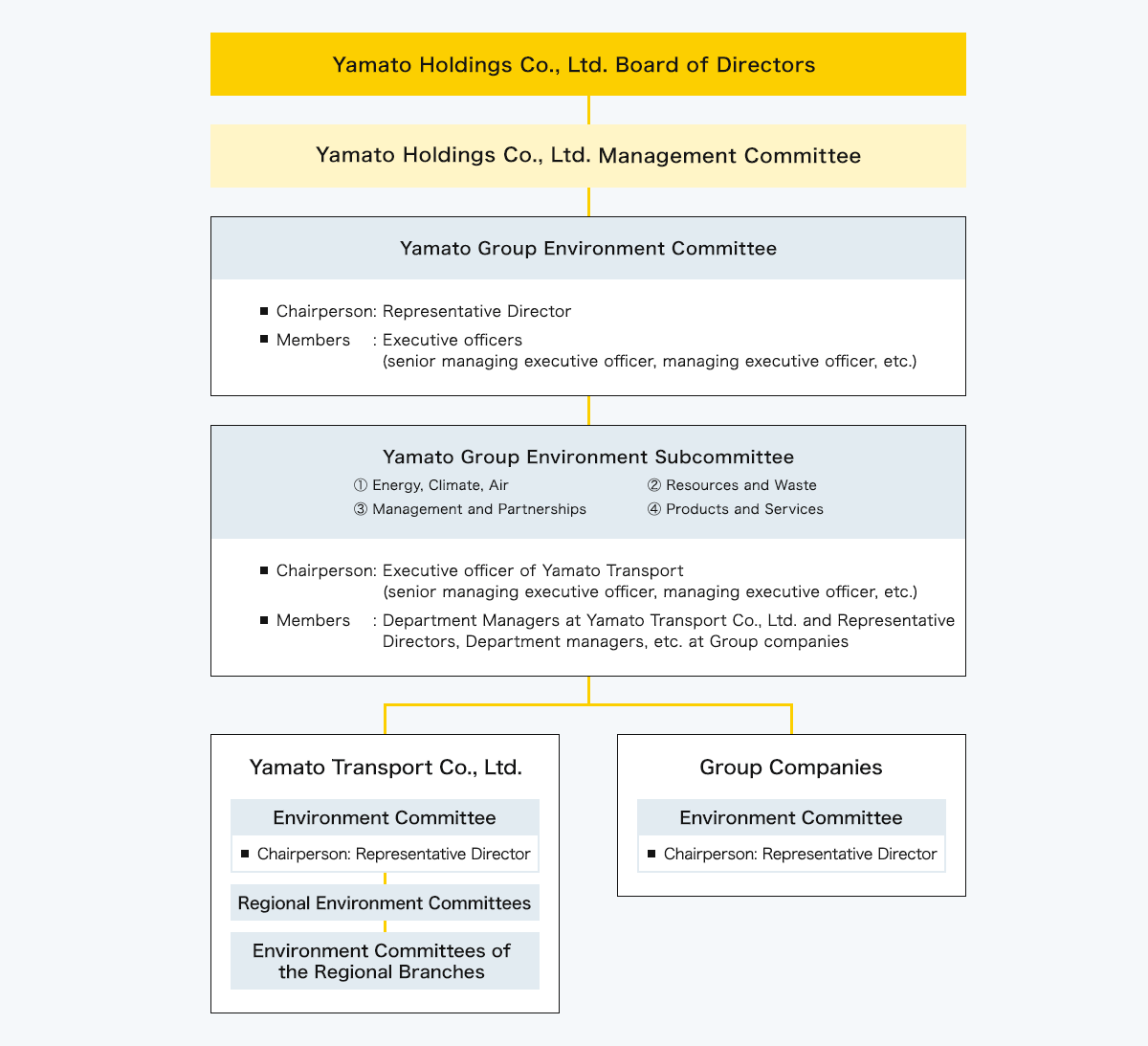

The Yamato Group deliberates and resolves on environmental issues, including climate change, based on an environmental management framework with the Yamato Group Environment Committee as the decision-making body, while the Board of Directors supervises the execution of these decisions. Specifically, the President and Representative Director chairs the Environment Committee and is responsible for overseeing environmental management. Then, important items discussed by the Environment Committee, such as Basic Policy on environmental issues, including climate change, are deliberated and resolved by the higher-level Management Committee and the Board of Directors. To achieve carbon neutrality by 2050 *¹, the Board of Directors determined in FY2022 a concrete intermediate goal of reducing GHG emissions 48% by 2030 from the FY2020 level*¹.

In addition, as environmental officers, the Executive Officers in charge of environmental fields and overseeing each region, and the Presidents of Group companies are responsible for ensuring the implementation, maintenance, and oversight of environmental management, including the preparation of the necessary management resources. Furthermore, in principle, all general managers and heads of field organizations are “environmental managers,” responsible for managing risks and opportunities related to the environment, including climate change.

- *1Scope1&2

Strategy

TCFD recommended disclosures

a. Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term.

b. Describe the impact of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning.

c. Describe the resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario.

(a) Short, medium and long-term risks and opportunities

The Yamato Group recognizes that risks related to the environment due to climate change may have long-term effects on the business activities of the Company and its stakeholders and that it is thus important to set different periods appropriately and examine risks for each period separately.The Group examines transition risks caused by the introduction of policy regulations by the government and changes in market needs, among other factors, and physical risks caused by extreme weather resulting from climate change and other factors. It focuses on the period from fiscal 2024 to fiscal 2026, being the implementation period of the Medium-Term Management Plan, as well as making reference to the GHG emissions reduction targets set by the Japanese government for the medium-term target period up to fiscal 2030, and the long-term target period up to fiscal 2050. The Group will reflect the risks and opportunities that it examines in its strategies.

The Group has evaluated physical risks as short-term risks, including suspension of business caused by more frequent and severe extreme weather events and an increase in repair costs arising from the damage to, and loss of, facilities and equipment. As for medium to long-term risks, the Group has evaluated the transition risk, that is, increases in expenses caused by changes to policies and laws resulting in a full-scale introduction of a carbon tax. With regard to opportunities, the Group has concluded that climate change has great potential for positive financial effects, such as a decrease in expenses due to energy conversion and an increase in efficiency to reduce carbon emissions, and an increase in revenue attributable to environmentally conscious customers' support for active actions to mitigate or adapt to climate change.

| Period | Definition | |

|---|---|---|

| Short-term | From FY2024 to FY2026 | Period of the Medium-Term Management Plan from 2024—2026 |

| Medium-term | From FY2027 to FY2030 | Period up to the year for which the Group has set its medium-term GHG emissions reduction target*2 |

| Long-term | From FY2031 to FY2050 | Period up to the year for which the Group has set its long-term GHG emissions reduction target |

- *2The Group has referred to the greenhouse gas (GHG) emissions reduction target set by the Japanese government to set those targets.

(b) Impacts of risks and opportunities on business, strategies, and financial plans and degrees of the impacts

The Yamato Group has approximately 55,000 vehicles and about 180,000 employees nationwide. Any carbon tax on GHG emissions from the Group's vehicles and facilities may have a significant impact on its finances. Failure to respond to requests for reducing carbon emissions and GHG emissions may lead to a decline in revenue due to changes in customer needs against the backdrop of increasing environmental awareness, which may have a significant impact on the Group's finances. For this reason, the Group thinks that it needs to take steps to achieve low-carbon transport to reduce GHG emissions. To this end, we will take measures including introducing 23,500 EVs), installing 810 solar power systems, designing operational methods that do not use dry ice, and replacing the electricity used with electricity derived from renewable energy sources by FY2030. To address physical risks, the Group makes good use of hazard maps when opening sales offices and updates the BCP manual regularly to avoid a suspension of business as well as damage to, or the loss of, facilities and equipment caused by more frequent and severe extreme weather events.

The Group will continue to conduct impact evaluations of other risks while creating other opportunities.

(c) Risks and opportunities and financial impacts based on related scenarios, and strategies and resilience related to them

STEP1 Risks severity assessment

[Criteria for evaluating the magnitude of impacts]

The Group has set three levels of severity (high, medium, low) based on criteria for evaluating financial impacts on annual revenue and expenses.

High: 10.0 billion yen or more / Medium: 1.0 billion yen or more and less than 10.0 billion yen / Low: less than 1.0 billion yen

[Occurrence timing]

Short-term (up to 2026) / medium-term (2027 to 2030) / long-term (after 2030)

| Impacts of climate change on the Yamato Group | Magnitude of impacts | Occurance timing | ||||

| Risks | Risks | Opportunities | ||||

| Category | Type | Risk driver | ||||

| Transition Risks | Policy and Legal | (1) Carbon Pricing | ・Profit may decline if we cannot pass carbon tax on to prices. | ・Revenue may increase if low-carbon transport is sold as added value. | High | Medium-term |

| (ii) Strengthened emissions reporting requirements | ・Revenue may decrease due to a loss in reputation if false reporting is made and found. ・System development costs and personnel expenses may increase in response to requests by business partners for precise reporting of GHG emissions. |

— | Low | Medium-term | ||

| Technology | (iii) Rising expectations for adding new technologies and high value to services | ・Revenue may decrease in the event of delays in responding to the transportation means and the deeper penetration of materials for curbing CO₂ emissions accompanying the shift to a low carbon society. | ・We may be chosen by customers as partners and revenue may increase if we introduce transportation means that will curb CO₂ emissions as the shift to a low carbon society takes place. | Low | Medium-term | |

| (iv) Request for low-carbon transport | ・Expenses for introducing low-carbon vehicles and equipment will increase. | ・If we promote low-carbon transport by introducing electric vehicles, energy used for vehicles may change from fossil fuels to electricity and procurement costs may fall. | Medium | Medium-term | ||

| Market | (v) Change in energy mix | ・Expenses for energy used for vehicles and facilities may increase due to sharp rises in fuel prices and electricity prices caused by the deeper penetration of renewable energy, etc. | ・The energy self-sufficiency rate may rise and energy costs may fall, reflecting the introduction of renewable energy power generation facilities and solar power systems and the promotion of energy-savings activities. | Medium | Medium-term | |

| (vi) Rise in consumers and customers' environmental awareness | ・Our service may be avoided and revenue may fall if we fail to fully respond to the rising awareness of corporate and organizational clients of the need to reduce CO₂ emissions throughout the supply chain and consumers' rising awareness of climate change and ethical consumption. | ・In eco-friendly corporate and organizational clients and those in EU countries, if expectations for reduced CO₂ emissions throughout the supply chain and growing consumer expectations relating to climate change and ethical consumption are met, our service will be chosen, thereby resulting in revenue increase. ・If consumers actively use delivery lockers and pickup services at sales offices, redelivery due to absence may be reduced and delivery efficiency may improve, which may reduce working hours and related costs. |

High | Medium-term | ||

| Reputation | (vii) Criticism of the industrial sector | ・Expectations for the transport industry are high because it affects Scope 3 emissions in other industries. If it fails to achieve low-carbon transport, revenue may decline. | — | Low | Medium-term | |

| (viii) Impact on funding | ・If we are categorized as a company that is not environmentally sustainable, funding may become difficult. | ・Funding may diversify with a shift to a low carbon society, and funding by a variety of means may become easier. ・Higher evaluation for our environmental initiatives will result in an expansion in investment and stock price stabilization. |

Low | Medium-term | ||

| Physical Risks | Acute | (ix) Increase in frequency and severity of extreme weather events | ・More frequent extreme weather events may lead to the more frequent suspension of business due to their effects on employees, delays in the recovery of facilities affected by extreme weather, and power and fuel supply disruptions, which in turn may cause a decrease in revenue. ・If customers' facilities and products are affected and shipments stop, revenue may fall. ・Damage to logistics facilities and equipment and cargo may increase losses and repair costs. |

・Increasing our capability to deal with natural disasters may increase demand from customers that are concerned about more extreme natural disasters, and this may increase revenue. ・We may reduce losses of business opportunities and expenses for restoration by relocating at an early stage business sites to places where the risk of natural disasters is low. |

Medium | Short-term |

| Chronic | (x) Rising sea levels | ・Costs may increase due to the impact of increased insurance premiums and expenses for flood disaster measures at logistics sites located in coastal areas | — | Low | Long-term | |

| (xi) Change in rainfall patterns and extreme changes in weather patterns | ・Decreases in shipments from customers significantly affected by climate change and water risk may cause a decrease in revenue. ・Delays in delivery due to disruptions to roads caused by flooding may increase related expenses. |

— | Low | Medium-term | ||

| (xii) Rise in average temperatures | ・Rising average temperatures may increase health damage, including heat stroke, to employees and may lead to difficulty in hiring employees and an increase in employees who leave the company, which in turn leads to increases in expenses, including personnel cost and recruiting expense. ・Rising average temperatures may cause an increase in energy consumption for temperature control at logistics facilities, which may result in an increase in utility costs. ・Local specialties may not be able to be harvested, which may cause a decrease in revenue from the delivery of fresh produce. |

— | Low | Long-term | ||

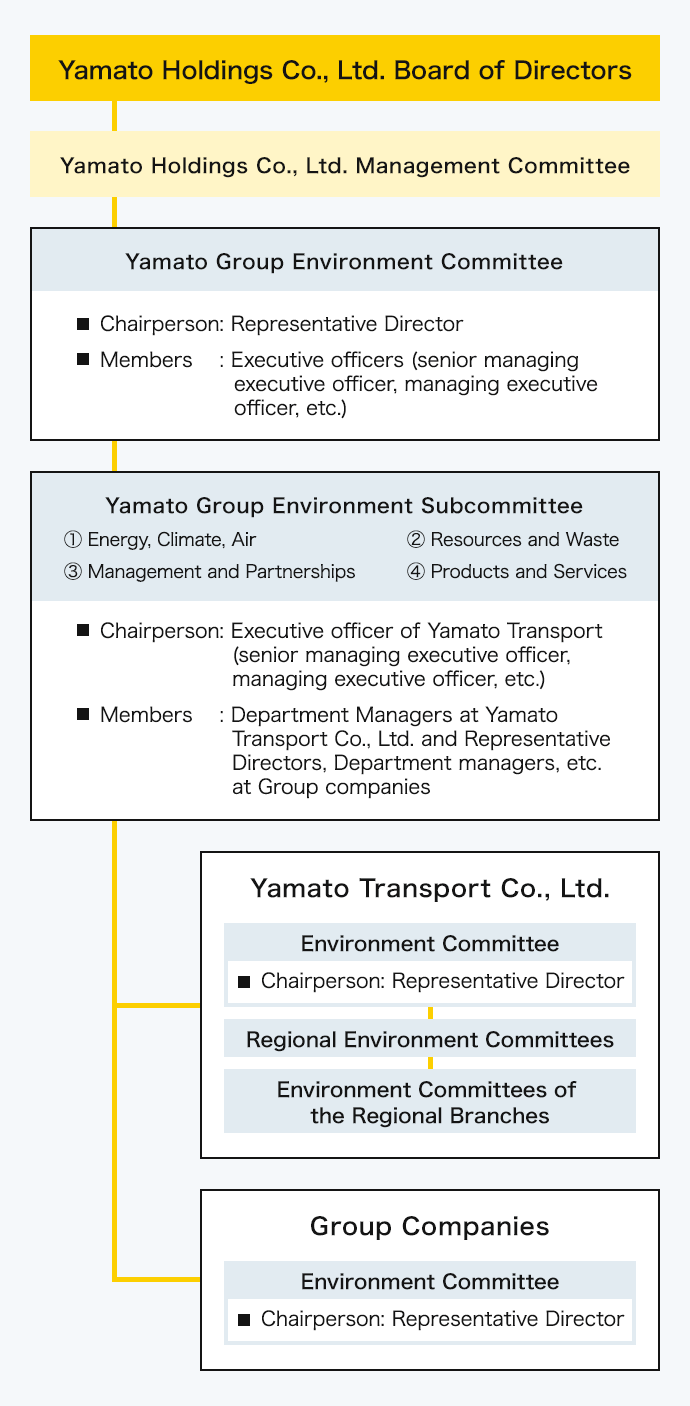

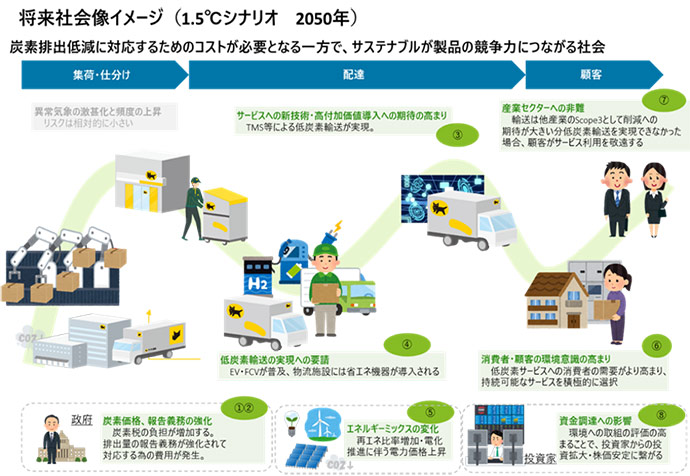

STEP2 Definitions of scenarios

In the scenario analysis that we performed in FY2023, we envisioned the below two scenarios for Yamato Transport Co., Ltd. based on information from the UN Intergovernmental Panel on Climate Change (IPCC), the International Energy Agency (IEA)*³, and so forth.

- *³IPCC…RCP8.5

IEA…Net Zero Emissions by 2050 Scenario, Sustainable Development Scenario, Stated Policies Scenario, etc.

STEP3 Evaluation of Business Impact

In FY2023, recognizing the possibility that the introduction of a carbon tax and abnormal weather and disasters would exert a particularly large impact on revenue and costs among the risks that we extracted, we performed the below analysis and business impact evaluation.

● Items evaluated

- AFinancial impacts of introduction of carbon tax

- BFinancial impact from decreasing revenues and increasing repair costs for facilities and equipment due to abnormal weather and disasters

- CFinancial impact from decreasing revenues and damage to facilities and equipment due to flooding

Details

- 1Evaluation of financial impacts of introduction of carbon tax

We calculated the business impact of a full-scale introduction of carbon tax in 2030 and 2050. We assumed that carbon tax will be $140 / t in 2030 and $250 / t in 2050. Based on the assumptions, the impact of carbon tax on Yamato Transport Co., Ltd. will be 15.7 billion yen in 2030 and 28.1 billion yen in 2050. - 2Evaluation of financial impacts of extreme weather and disasters, that is, a decrease in revenue and an increase in facilities and equipment repair costs

We estimated the business impact—that is, a decrease in sales and the cost of repairing facilities and equipment*⁴—of extreme weather such as severer typhoons and heavy rains caused by linear precipitation zones. The business impact is estimated at 1.9 billion yen in 2030 and 3.8 billion yen in 2050. - 3Financial impact assessment regarding decreasing revenues and damage to facilities and equipment due to flooding Based on floodwater depth projections using hazard maps, AQUEDUCT*⁵, etc., the business impact was estimated for the amount of loss due to the suspension of operations and asset damage to facilities and equipment, using the damage rates by floodwater depth provided in “A Guide to Flood Risk Assessments for Enhanced TCFD Disclosures” by the Ministry of Land, Infrastructure, Transport and Tourism.

As a result, we calculated that the annual impact of a 1-in-100 year flood (floodwater depth) under the 4°C scenario (RCP8.5) on the amount of lost business and property damage would be 400 million yen in 2030 and 430 million yen in 2050.

[Conditions used in the analysis]

・Average of 5 climate models*⁶

・Average value of 3 km square including the surrounding area with 1 km spatial resolution

・49 sites surveyed, including sites with the potential for flooding on hazard maps

- *⁴Estimated by reference to past disasters

- *⁵AQUEDUCT, a risk assessment tool developed by the World Resources Institute (WRI)

- *⁶GFDL-ESM2M (National Oceanic and Atmospheric Administration);

HadGEM2-ES (a U.K. climate research institute);

IPSL-CM5A-LR (a French climate research institute);

MIROC-ESM-CHEM (University of Tokyo, etc.); and

NorESM1-M (a Norwegian climate research institute).

STEP4 Direction of countermeasures

- 1Introduction of carbon tax

The Yamato Group strives to reduce GHG emissions, setting an ambitious goal of reducing its own emissions to carbon neutrality in 2050.

(i) The Group aims to reduce GHG emissions by 48% from FY2020 by FY2030. The main initiatives to achieve this goal include introducing 23,500 electric vehicles and installing 810 solar power systems by FY2030. We estimate that those initiatives will reduce, compared with the case where such initiatives were not implemented, the impact of carbon tax by 7.4 billion yen in FY2030.

(ii) Up to FY2050, the Group will implement other initiatives, including introducing cartridge battery EVs and other low-carbon vehicles and installing additional solar power systems to increase the ratio of electricity generated via renewable energy sources in electricity consumption. The Group expects that if it achieves its goal of reducing its own emissions to carbon neutrality, carbon tax will have no impact on its finance.

(iii) The Group is considering introducing internal carbon pricing to promote capital investment to reduce carbon emissions. - 2Decrease in revenues and increase in damaged facility and equipment repair costs due to abnormal weather and disasters

In addition to making good use of hazard maps when opening sales offices and updating the BCP manual regularly, the Yamato Group is considering disseminating information about adapting to climate change in the Group and to the partners.

The Group will increase the usage of renewable energy to enhance resilience, and conduct demonstrations of usage models for cartridge BEVs.

The Group will reevaluate business impacts, adding assumptions, including places of occurrences of extreme weather events and the scale of them, and continue to examine countermeasures. The Group will continue to undertake those initiatives and expedite them. Examining how to handle other risks and opportunities is also a management issue. - 3Initiatives to seize opportunities for increased environmental awareness among consumers and customers

In order to achieve “net-zero (in-house) greenhouse gas (GHG) emissions by 2050,” the Yamato Group is promoting the reduction of its GHG emissions by introducing EVs and solar power generation equipment, etc. At the same time, in order to optimize our customers’ inventory and production activities, we are building a supply chain with a lower environmental impact. To this end, we are working to create new value to offer to our corporate customers, including the development of a GHG emissions visualization tool in compliance with the international standard ISO 14083:2023. During the fiscal year ended March 31, 2024, we made a carbon neutral claim for TA-Q-BIN, TA-Q-BIN Compact, and EAZY (the three parcel delivery services). This claim consists of achievement of carbon neutrality pursuant to the international standard ISO 14068-1:2023 in the fiscal year ended March 31, 2023 (April 2022 - March 2023) and commitment to achieving carbon neutrality for the three parcel delivery services by 2050 through continuous efforts to reduce in-house GHG emissions from our business activities. Through the provision of such climate-friendly transportation services, the Yamato Group will further promote the use of these services by individual and corporate customers. We will also promote the commercialization of new business models that meet the diversifying needs of customers and society. Based on our vehicle maintenance business, we will develop platform and ecosystem that achieves both decarbonization and economic efficiency by supporting introduction and operation of commercial EVs utilizing know-how of EVs, solar power generation equipment, energy management, etc. accumulated so far through environment investment and demonstration experiment within the Yamato Group, thereby aiming to contribute to the Yamato Group’s profit growth and the sustainability of society and the logistics industry as a whole.

- *Detailed information on analyses and assessments can also be found in the answers to the Yamato Holdings Co., Ltd. CDP Climate Change Questionnaire.

Risk Management

TCFD recommended disclosures

a. Describe the organization's processes for identifying and assessing climate-related risks.

b. Describe the organization's processes for managing climate-related risks.

c. Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management.

The Yamato Group has established a dedicated department to promote and supervise the Group's overall response to climate change at Yamato Holdings Co., Ltd. Each Group company has an Environment Officer (Representative Directors) and an Environmental Management Representative (a person responsible for promoting environmental initiatives) to promote group-wide efforts to address climate change.

The Yamato Group Environment Committee chaired by the Representative Director, whose main members are Yamato Transport's executive officers who chair Environmental Subcommittee, executive officers responsible for regions and the representative directors of major Group companies, holds a meeting once a year and shares information about and discusses environmental issues and risks, including those related to climate change. Important agenda items are discussed and resolved by the Management Committee and the Board of Directors as appropriate.

Metrics and Targets

TCFD recommended disclosures

a. Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process.

b. Disclose Scope1, Scope2 and, if appropriate, Scope3 greenhouse gas (GHG) emissions and the related risks.

c. Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets.

(a) Metrics for evaluating climate-related risks and opportunities in accordance with the Group's strategies and risk management process

A dedicated department has been established in our Company to oversee the promotion of measures related to climate change throughout the Yamato Group. In addition, each Group company has appointed an environmental officer (President and Representative Director) and an environmental promotion representative (Promoter), as the entire Group promotes action against climate change.

The Yamato Group Environment Committee, chaired by the President and Representative Director and composed of Executive Officers, etc. of Yamato Transport Co., Ltd. and Presidents of major Group companies, meets once a year to deliberate and resolve issues and risks related to the environment, including climate change. In addition, important items are discussed and resolved at the Management Committee and the Board of Directors as necessary.

Greenhouse gas emissions

The Yamato Group posts its GHG emissions on its website.

Targets and results used to manage climate-related risks and opportunities

【GHG emissions reduction targets】

Short-term: 25% reduction compared to FY2020 by FY2026

Medium-term: 48% reduction compared to FY2020 by FY2030

Long-term: carbon neutrality by FY2050

【Target ratios of electricity generated via renewable energy sources】

Short-term: 70% of total electricity consumption by FY2026

Medium-term: 70% of total electricity consumption by FY2030

*The Yamato Group posts the ratio of electricity generated via renewable energy sources on its website.

While pursuing initiatives to achieve the targets above, the Group is considering achieving SBT 1.5℃ certification.